top of page

Search

HMRC

The UK Confirmation Statement: Your Must-Know Guide for Annual Filing

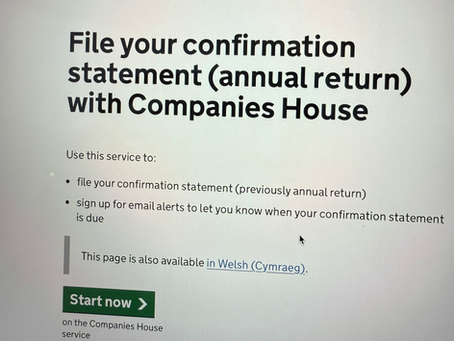

The Confirmation Statement is an annual requirement for UK companies to ensure that their records with Companies House are accurate. It replaced the Annual Return in 2016, streamlining the process to simply confirm existing details or update them if anything has changed. Filing on time is vital to avoid penalties, maintain compliance, and ensure transparency for shareholders and other stakeholders.

Lizzie O

Jun 1, 20252 min read

How to Incorporate Your Business in the UK: A Step-by-Step Guide

"Incorporating your business in the UK comes with big benefits like limited liability and tax advantages. Our simple guide walks you through the process step by step—from choosing a name to registering with Companies House.

Lizzie O

May 18, 20252 min read

Taxes for Content Creators and Influencers: Your Essential Guide to HMRC Rules

If you’re earning money as a content creator or influencer, taxes might feel overwhelming, but they don’t have to be. From understanding trading income to navigating the £1,000 allowance, this guide breaks down everything you need to know to stay on top of your financial obligations. Dive in to learn how you can keep HMRC happy while focusing on growing your brand.

Lizzie O

Apr 16, 20253 min read

Audit Exemptions for Private Limited Companies: A Complete Guide

Understanding audit exemptions can save you time and resources while ensuring compliance with the law. This guide will walk you through everything you need to know about audit exemptions for private limited companies.

Lizzie O

Apr 13, 20253 min read

bottom of page